Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

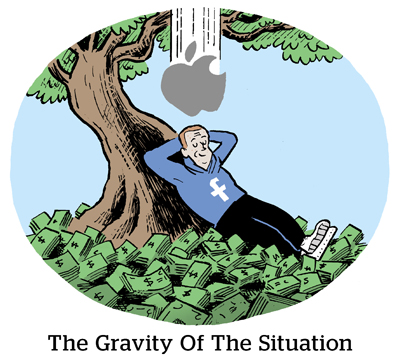

At What Point Do We Reference Myspace?

Meta faces an existential crisis. It was a trillion-dollar company one year ago and is now worth a mere $370 billion.

“Mere” is relative – that’s still big. But this is a make-or-break moment for Meta.

CNBC attributes Meta’s crisis primarily to the ebb and flow of people (mostly ebbing in the case of Meta and the flagship Facebook app). Recruiting engineers is a problem, and users are leaving for other apps.

One analyst, Needham’s Laura Martin, actually has a “Sell” rating on Meta.

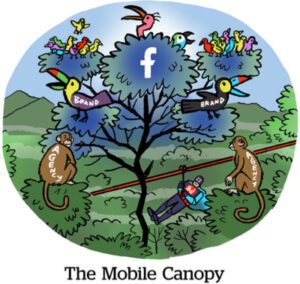

The main issue, and what makes this an existential crisis despite Meta’s huge cash flow, is that Meta is almost 100% dependent on ads. Meta has billions of users across its portfolio of apps, and it could handle some users sloshing between buckets (from Facebook to Instagram, for example). And it could even deal with some outright spillage. But ATT has left its mark, and Meta hasn’t been able to reestablish the prospecting and personalization flywheel that used to make its ad platform hum.

The math hurts: Meta has more than enough users, but not scaled conversion data.

Also, being reliant on ads means being reliant on advertisers – and advertisers can be fickle.

“I’m not sure there’s a core business that works anymore at Facebook,” says Needham’s Martin.

The Growth Torch

TikTok’s annual revenue in the UK and Europe increased from $172 million last calendar year to more than $990 million this year.

That’s impressive. However, the company’s losses in the region are up by a third to $896 million, the Financial Times reports based on a filing to the UK business administration agency.

TikTok attributes these losses to hiring and expansion, including almost doubling its costs in sales and marketing.

Social media companies like Facebook, Pinterest, Snap and Twitter can only look on in envy. For most of the past decade, they’ve been considered growth investments by public market standards. Investors accepted losses on the grounds that each platform would eventually graduate to profitability. But that is no longer the case.

Wall Street is getting impatient and investors want to see mature behavior and sustainable profitability … and that has meant heavy layoffs, restructuring and shuttering wholesale business units.

TikTok, however, has more freedom to operate as a private company. It can hire through the downturn (which pays dividends) and ramp up advertising. Last month, Snap CEO Evan Spiegel yearningly spoke of TikTok’s “unimaginable” ad budget.

But even if TikTok was a public company, it’d be in a good position. It’s got the magic-multiplier allure of a growth-stage investment.

A Bust For Trustbusters

The Big Tech antitrust bill penned by Senators Amy Klobuchar and Chuck Grassley has buzz and momentum – everywhere except in the halls of Congress.

The so-called “American Innovation and Choice Online Act” would prevent companies like Google, Meta and Apple from self-preferencing their own products across platforms they operate.

But only 26% of US lawmakers support the bill as written, according to a survey of congressional aides conducted by Punchbowl News. That’s better than the 17% of lawmakers who outright oppose the bill, but the rough stat is 57% undecided.

The bill’s backers need a surge of advocacy and interest to move it along. But the issue just hasn’t surfaced on the radars it needs to. (And Senate Majority Leader Chuck Schumer has also been dragging his heels.)

This is despite the fact that the bill has been touted as a rare example of bipartisan legislation, with sponsors from both parties.

But the Punchbowl survey casts doubt on how widespread – and how bipartisan – the bill’s support really is. Currently, 41% of Democrats support the bill and 7% oppose, whereas only 11% of Republicans support it and 28% oppose. That suggests support for the bill has divided along the usual ideological lines, which is usually a bad sign for legislation looking to get across the finish line.

But Wait, There’s More!

The next big battle for Google and Apple is for the soul of your car. [WSJ]

TikTok to launch live shopping in the US using outsourced technology. [FT]

The tech site that took on China’s surveillance state. [The Atlantic]

Mike Shields: Why Vox Media is hedging its bets in ad tech and data. [blog]

What are the top 10 alternative ID solutions and how do you use them? [AdMonsters]

FuboTV touts ad spend growth from Unified ID 2.0 platform. [Fierce Video]

You’re Hired!

Steve Silvers has left Neustar to become Kantar’s new EVP of product development, global media and creative. [LinkedIn]

FreeWheel’s former general manager, Dave Clark, takes on the TripleLift CEO gig. [tweet]